There is no exit load if you sell off the units 1 yr after you purchased them. Broker charges check with the fees or commissions levied by brokerage firms for facilitating trades on behalf of traders. A brokerage payment is a fee charged by a broker to execute transactions or provide specialized providers. The charge is for providers similar to broker fees gross sales, purchases, consultations, and delivery.

What Is Brokerage: Meaning, Sorts, & Extra

Contents

- 1 What Is Brokerage: Meaning, Sorts, & Extra

- 2 Is There Any Tax On Intraday Buying And Selling

- 3 What’s A Brokerage Calculator?

- 4 Video Old Clip Of Jaya, Swetha Bachchan Offering ‘marriage Recommendation’ Resurfaces Amid Aishwarya-abhishek Divorce Rumours

- 5 Q: What Is Brokerage In The Stock Market?

- 6 © Enrich Financial Market Pvt Ltd All Rights Reserved

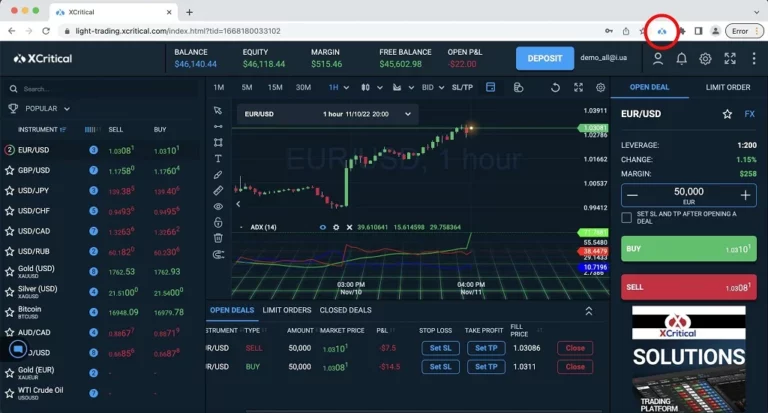

From traditional brokers to on-line platforms, there are various types of brokers catering to different needs. Leverage is a crucial idea within the inventory market, that each trader ought to be conscious of. It is a robust software that can assist multiply your funding potential and returns. Here’s every thing you should know concerning the idea of leverage and its numerous advantages.

- In such a state of affairs, it might be cheaper to pay a lump sum amount upfront to nullify the monthly AMC costs.

- Several brokers additionally charge a flat brokerage fee per trade which usually ranges between ₹10 to ₹100 per trade.

- Trusted by over 2 Cr+ purchasers, Angel One is one of India’s leadingretail full-service broking houses.

Is There Any Tax On Intraday Buying And Selling

Users shall be the only real owner of the decision taken, if any, about suitability of the same. Subject company could have been client during twelve months previous the date of distribution of the research report. Insurance isn’t a Exchange traded product and the Member is simply acting as distributor.

What’s A Brokerage Calculator?

In distinctive scenarios, brokers might obtain commissions from each the insurer and the individual buying the coverage. The minimal brokerage charge refers to the lowest or minimum brokerage amount that a dealer expenses on each trade. The precise charges might differ from one dealer to another and depend on a number of other elements, just like the trade value or the type of trade taken.

Video Old Clip Of Jaya, Swetha Bachchan Offering ‘marriage Recommendation’ Resurfaces Amid Aishwarya-abhishek Divorce Rumours

Understanding these prices is key to precisely assessing the true financial impression of your buying and selling actions. The intraday brokerage costs would possibly differ relying on the charge construction and the dealer. Usually, for futures, the brokerage costs are imposed as a flat charge per commerce or a percentage-based payment. Regarding percentage-based charges, the payment may be between zero.01% to 0.05% of the contract’s total value. The traders must evaluate the construction of charges provided by different brokers and select the one that might be cost-effective for them and their buying and selling necessities. The brokerage charged on intraday trading varies primarily based on the kind of broker.

Stockbrokers can accept securities as margin from their clients only by means of a pledge in the depository system w.e.f. 1st September 2020. Update your email ID and mobile number with your stockbroker/depository participant and receive an OTP directly from the depository on your registered email ID and/or cell quantity to create a pledge. Accordingly, any brokerage and funding providers provided by Bajaj Financial Securities Limited, including the services described herein usually are not obtainable to or supposed for Canadian persons. The brokerage fee is charged by the dealer if you purchase or promote shares on their platform. A brokerage payment is critical for the stockbroker to fund their operations. Therefore, merchants can utilise a brokerage calculator to greatly benefit their trading process and save time on price analysis considerably.

Q: What Is Brokerage In The Stock Market?

If the share is value Rs 10,000 and the brokerage fee is 0.1%, the entire amount involves Rs 10. It provides a variety of economic services, such as fairness buying and selling, commodity trading, and so forth. Your dealer also costs sure charges for its providers, referred to as brokerage expenses. The common brokerage charge on purchasing ETFs is zero.01% of the turnover worth. You should do not overlook that a brokerage cost must be paid each during the shopping for and the selling of a share.

© Enrich Financial Market Pvt Ltd All Rights Reserved

They can be people or institutions usually addressed as stock brokers, brokerages, or brokerage companies. As evident above, m.Stock is the most fitted choice for you as you pay zero brokerage in your intraday trades across merchandise for life! Let us now perceive how intraday brokerage is actually calculated. Expense ratios are the most important prices involved in ETFs or Mutual Funds. The internet expense ratio consists of waivers, reimbursements, and trading costs, whereas the Gross expense ratio is the identical as the percentage of whole mutual fund property used to run the fund.

An quantity that is categorized as ‘Annual upkeep charges’ is deducted by the broker out of your account. If the AMC charge is deducted every month that deducts a sizeable portion of the fund you invested. In that case, it’s higher to pay a bulk amount at the beginning, and having the month-to-month AMC charges nullified.

Brokerage fees typically comprise a fixed cost and a proportion of the whole transaction worth. The fixed cost remains constant, while the percentage part fluctuates primarily based on the transaction quantity. Brokerage calculations vary based on the kind of asset being traded.

This means that the impact of brokerage charges on their overall returns is minimal. Investors can typically afford to ignore these fees because they do not eat significantly into their profits. However, should you sign up for Trade Free Plan with Kotak Securities, forgo all brokerage costs for intraday transactions. Full-service brokers are traditional brokers who are likely to charge the next brokerage as they promise to share recommendations on the inventory market as properly. A low cost dealer, however, provides a no-frills access to the trading terminal and thus, charges a a lot lower brokerage.

Read more about https://www.xcritical.in/ here.